The important things to know about the IPO lockup period

Early investors in a company that is about to go public need to understand what the IPO lockup period is. If they choose to cash out, what they need to do is sell their shares and gain profit. However, things do not always move this quickly. After an IPO, many companies are going to tie up their stock through a lockup period that keeps investors from cashing out too soon.

The initial public offering, also known as the IPO lockup period, is a signed restriction that prevents shareholders of a company from selling the stock before the company goes public. This period can vary, and it is usually happening anywhere from 90 days to 180 days since the day of the IPO. In this article created by our team at TMS, will explore in more detail the IPO lockup period and how it works.

What is an IPO lockup period?

A lockup period means that there is a predetermined time frame in which corporate insiders, investors, or employees cannot sell or redeem their shares after an initial public offering. This happens when a company offers its first public stock.

A lockup period is a contract that states there is a period after a company goes public when the major shareholders are not allowed to sell their shares. The lockup usually lasts between 90 and 180 days. When this period ends, the trading restrictions get removed.

Any investor or employee wants the lockups to be as short as possible so that they can cash out early. However, underwriting banks would ideally like the IPO lockup period to be longer to prevent insiders the drop of the share price. The company itself is usually in the middle. They want to be sure the investors are happy with their returns but also don’t want to show that insiders lack the faith in the stock.

The goal of an IPO lockup period is to stop the flooding of the market with too much of a company’s stock supply. Usually, just 20% of a company’s shares are offered for the investing public. If a significant shareholder is trying to unload all their holdings in the first week, they can send the stock down, and this does not help anyone.

There is significant evidence that suggests that at the end of the lockup period, stock prices experience a permanent drop of about 1% to 3%. What is also worth noting before a company goes public is that it often goes through an underwriting process where an underwriter is a bank.

Its goal is to structure and support the IPO to make it successful. One of the most common ways is to do this by agreeing to buy the entire inventory of stock of a company.

Quiet Periods

When talking about IPOs, companies need to have a quiet period that takes place before and after the IPO. For the executives of a company, this is an SEC-mandated period of 40 days in which they are prohibited from offering new information. However, this is not available to the public using the S-a filing.

The window of time that is first requested by SEC is the pre-issue (the quiet period mentioned above) that extends from the date a company files the registration statement with the SEC. This lasts until the day the account becomes effective.

During this period, the SEC limits public discussion or marketing for the upcoming share offering by the company. The second-quarter period lasts 40 days and comes after the IPO. During this time, the staff and syndicate members are not allowed to comment on anything about any projected earnings or issue research reports.

The IPO lockup period also has a quiet period regarding the research reports that relate to the IPO. Even though there is no deadline set here, sell-side analysts that participated in the IPO go through the do not publish anything for 20-30 days after the IPO date underwriting process.

The idea behind this is to stop any conflict of interest that might appear in connection with the stock.

Why should you know the IPO lockup period expiring date?

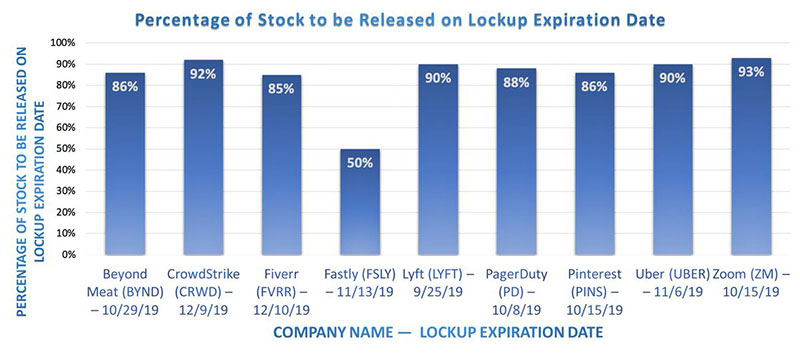

This is an important topic, and if this is the first time you have heard about this concept, here is an explanation. When you want to invest in a company that has made an initial public offering, you need to determine if the company has a lockup and when it expires. This is important because the price of the company’s stock can drop as a result of the locked-up shares that are going to be sold in the market when the lockup is finished.

It is important to consider the fact that every stock is different when using expiring lockups as the motivation to put on a trade. Some might go down a lot, or even collapse as a result of the IPO lockup period ending. Others might flourish and increase their prices. Most of the time, a stock is going to dip a few days in advance before the lockup expiration.

However, they quickly recover and rise even higher than before. The idea being that these dates influence the stock price and you need to pay attention to them.

To discover if a company has an IPO lockup period, you can contact the company’s shareholder relations department. Another option is to get this information online using the SEC’s EDGAR database. Some commercial websites also track when companies have their IPO lockup period set to expire. The SEC does not endorse these websites and makes no representation about the information that is contained on them.

The usefulness of the IPO lockup period

The primary purpose of an IPO lockup period is to stop investors from flooding the market with a high number of shares, which would make the stock price drop. Company insiders have a high percentage of stock shares compared with the general public. Having a higher volume means that when they sell them, this activity can impact the share price very fast after the company goes public.

IPO lockup periods let the new shares to stabilize in the market without any pressure from the investors. This period allows time for the shares to flow naturally between supply and demand. At the start, liquidity can be low but will increase in time.

A company, together with its underwriters, can use the lockup period as a tool to bolster the share price in the IPO. Shares that are held by the bank or investors can be sold during the IPO, but shares owned by company insiders like founders, executives, and more are subject to a lockup period.

Another use of the lockup period is to retain key employees. When stock awards are not redeemable, they keep an employee from moving to the competitor, maintain continuity, or until they completed a critical mission. Lockup periods can be a way for companies to keep up appearances. When the closest to the company keep their shares, they can signal to investors that they have confidence in the power of the company.

If you enjoyed reading this article on IPO lockup period, you should check out this one about Steve Jobs leadership style.

We also wrote about a few related subjects like risk assessment matrix, business process modelling, business model innovation, business model vs business plan, accelerator vs incubator, startup funding stages, how to value a startup and IPO process.