The most exciting fintech startups you should watch this year

We are currently experiencing some of the most exciting times for fintech startups. This is because this in-demand industry has become a standard, and the possibilities are endless.

Each year, we see all kinds of fresh innovations that come from the tech industry. This year has brought some remarkable fintech startups in the game, and we can see a steady evolution. But this also comes with a lot of regulatory policies that are approved and sometimes can reduce the speed of progress.

The fintech startups industry reached in 2018 a funding of $ 32.6 billion at the end of the Q3. This year could be one of the biggest ones for top fintech companies that are about to reach the unicorn status, going more than $1 billion valuations. In this article created by our team at TMS, we will explore more about this.

What are fintech startups?

Before we continue, let’s make sure that we are at the same page when talking about fintech. It is a known abbreviation used for the term financial technology that appeared in the 70s. Even though it is an older concept, it garnered its popularity starting in 2018 when it was added to the dictionary.

We are talking about an innovative industry that offers financial services using the software, cloud, and other modern technology. Fintech provides consumer and business applications, and it can go from cryptocurrency to mobile payments.

Many applications have been using this concept, and it is a clear sign that fintech startups are changing how consumers access their finances. Some of the fintech companies that are alive today have created mobile payment apps that may even have the chance to disrupt the traditional financial and banking industries. Therefore, some banks and financial institutions view the fintech startup sector as a threat.

Nearly two billion people worldwide do not have their own bank account. Here is where fintech jumps in and takes advantage of the situation by providing an option to participate in the financial services without the need for brick-and-mortar. This is the exact reason why fintech startups were created in the first step. They give consumers the option to use financial services through easy-to-use technology.

Besides that, these fintech startups are bringing innovative solutions for small business owners. When looking for a low-cost solution for your business accounting or finance the fintech is an excellent space to check out.

Fintech startups to check out in 2019

Next, we are going to take a look at some of the top fintech companies of 2019 and explore what they managed to create and execute.

Betterment

Betterment is currently the most prominent independent online financial advisor. It has $18 billion in assets under management. The idea behind the service is to help by increasing the customer’s long-term returns. They focus on retirement planning, building wealth, and similar goals.

By using advanced investment strategies, Betterment uses technology to satisfy the more than 450,000 customers that they currently have. They do so by using three business lines:

- Direct-to-consumer

- Betterment for Advisors

- Betterment for Business

FinTech School

FinTech School was created by entrepreneurs and experts that lived what they preach. They offer fintech training to individuals and institutions. Compared to the traditional methods, which focus solely on theory, the approach here is to hire entrepreneurs that are looking to build fintech companies to share their industry knowledge based on their own experience.

Bita

Another fintech startup that we like is Bita. Bita is an index and data provider for the digital asset space. This startup has created software for systematic investing and institutions that are operating around this space. It was founded in 2018, and only one year later, they have received 1.25 million euros from investors that focus on this kind of platform.

Avant

Avant is used to getting loans ranging from$1,000 to $30,000 quickly. The goal of the company is to disrupt the lending industry, and it seems to be a good start. It was founded by Paul Zhang, John Sun, and Al Goldstein. If we go back to 2012, it has been seven years since it was started, and the company is currently worth $2 billion.

Avant has more than 600,000 customers, and it helps its consumers by providing a lower credit score. The best part about Avant is that consumers can get instant loans online without much complication.

Heliocor

Heliocolor is one of those fintech startups that have a chance to disrupt how we see online services. It is one of the top fintech companies launched in 2019 and is making waves due to the services it offers. Whether you runan online business, an e-commerce store, or you are an app developer, you will need to be GDPR-compliant today, which is what Heliocolor helps you do.

Not only does Heliocolor have this service, but it is also used in various-eCommerce stores. They use it because it helps them stay compliant with the laws of the state and for fraud detection and prevention.

ClauseMatch

This pioneering company started to create its Saas platform to get smart document management. They did this well before GDPR and ESMA regulations appeared. Because of this, ClauseMatch helps UK banks and financial institutions to centralize their compliance intelligence and keep all internal policies, procedures, and documents well organized.

Due.com

Due.com has changed its website and it is even easier to use now. This fintech startup relates to invoices. It helps clients design their invoices and access data reports from the dashboard in a simple way. It is a free invoicing service that has hundreds of templates for business owners to use.

Adyen

Let’s check one of our favorite fintech startups from Amsterdam that offers businesses a single solution to accept payments no matter where you are in the world. It helps more than 4,500 business, and there are some big names here:

- Uber

- Airbnb

- Netflix

- Spotify

- Dropbox

- Vodafone

- Soundcloud

Tala

Tala helps people by offering credit in underserved parts of the word. It is a simple app, and they help users get their confidence.

Klarna

Klarnais a startup that was launched in Sweden, and it changed the online shopping world. Klarna lets customers pay for an order after they have received it. It sounds like a bit of a nightmare for eCommerce, right?

Not really, because Klarna takes all the risk. It is a win-win for both the customers and sellers who want to increase their conversion rates with a simple solution.

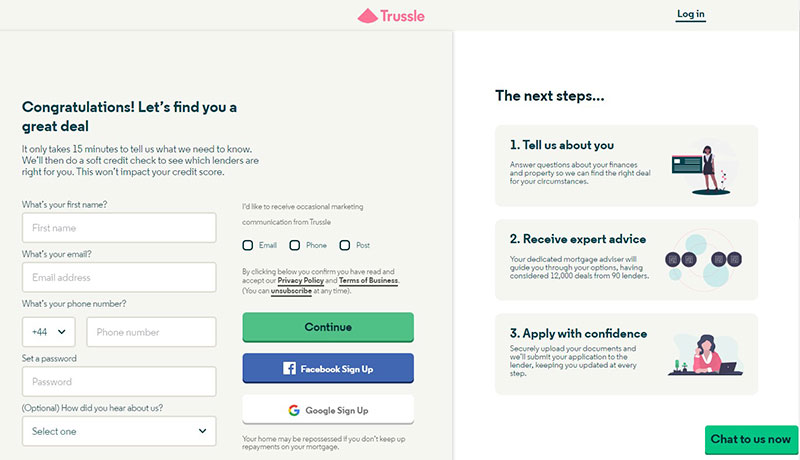

Trussle

If you are looking to reshape your mortgage broker, Trussle is one of the best tools to use. Trussle has more than 11,000 mortgage deals available from different lenders. Finding the best mortgage can be difficult, but this fintech company helps you do it quickly and simply.

Trussle’s clients can save up to 4,000 pounds per year, and what’s even better is that the goal of the Trussle software is to find the best deals available. It does so by continually monitoring the market place and letting you know when a better deal becomes available.

Robinhood

Robinhood is known as a disruptor and is one of the most innovative companies in the world. The products done by Robinhood have even won awards such as:

- Apple Design Award

- Google Material Design Award

- Fast Company’s Innovation by a Design award

Stash

Stash is a simple mobile app that you can use to start investing with, starting with only $5, using strategies that sound good for you. The approach that it uses is different than anything else out there. In particular, it uses the Conservative mix, where a blend of the diverse collection is added by following the lead of a professional investor.

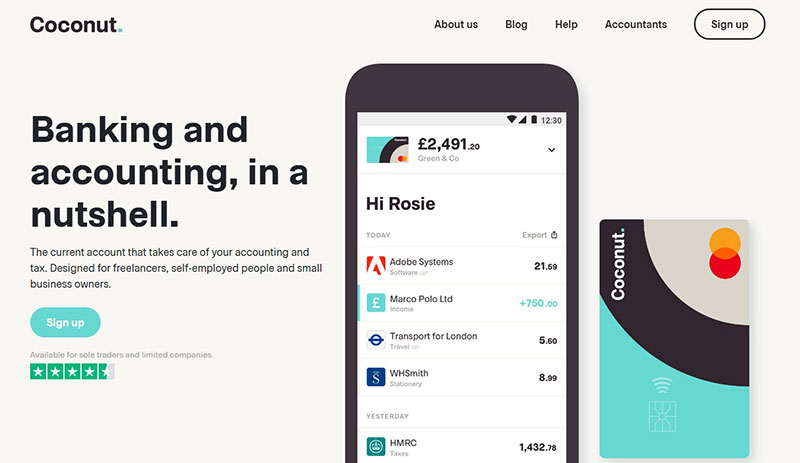

Coconut

Another tool our fintech startups list is Coconut. Coconut is currently looking to launch its first subscription service, which has unlimited invoicing and end of year tax reports. Coconut looks to be an attractive option for small business owners that do not have the time to deal with their accounting.

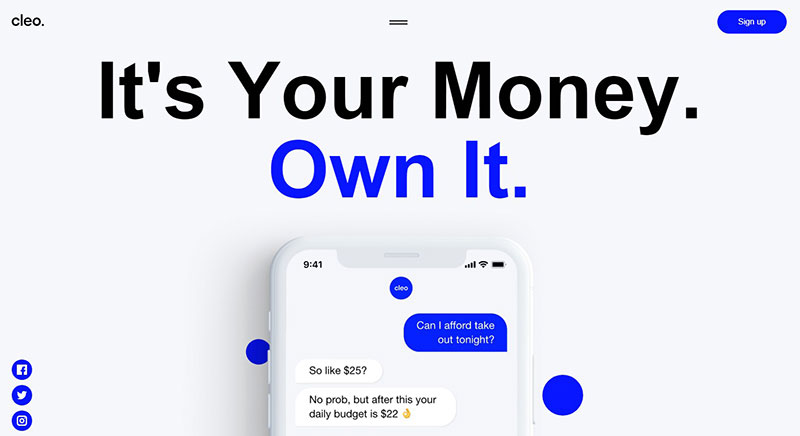

Cleo

If you have ever been in a situation where you are not sure how much money you have in your bank account, Cleo is here to help. Cleois an AI-powered chatbot that connects to your bank accounts and credit cards and offers insights on how you are spending your money. The most fun feature is that it can answer your questions by just using Facebook Messenger.

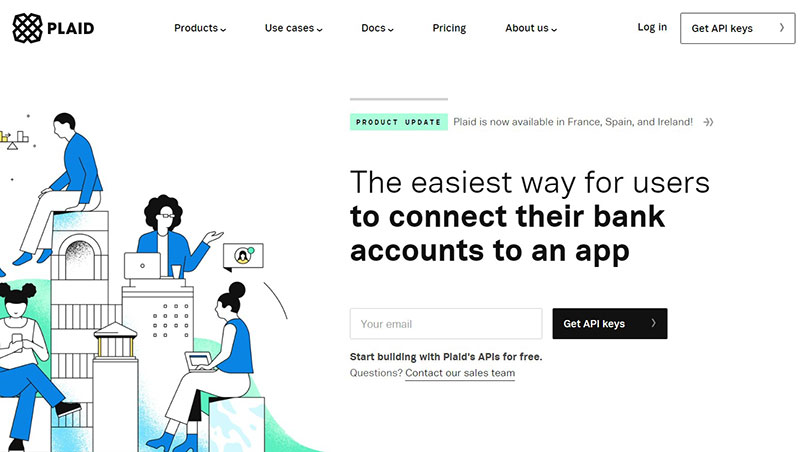

Plaid

Plaid is one of many successful startups to come out of 2013. Plaid was created by Zach Perret and William Hockey, and what it does is allow different applications, such as payment apps, for example, to connect to the user’s bank accounts and help to speed up the authentication process.

The company has grown significantly recently and has helped connecting apps like Betterment and Venmo together with user’s accounts. Plaid has the chance to get even longer, but only time is going to tell what happens.

SecuredTouch

SecuredTouch is a mobile fraud detection app that has analyzed over 100 behavioral parameters to keep your information secure. It uses behavioral technology that activates seamless authentication for any device. Their HUMANBOT solution uses advanced machine learning to identify user activities like swipe speed, finger pressure, or device movement. It does so to separate actions from non-human behaviors.

Planwise

Planwise was created to help people simply gain confidence and skills. A user-friendly software program guides customers when they evaluate their current financial situations.

Titan (YC S18)

Titan is a next-generation investment manager. Titanis built like a hedge fund; the app invests users’ money in a portfolio of incredible companies that are favored by top hedge funds.

This means that users get the chance to use it and become better investors at the same time. It is a great app, and anybody should take advantage of it, even more, when you are new to investing.

Circle

Circle is a simple peer to peer payment platform where its users can send or receive payments via the ap or even in iMessage. It raised $100 million, pushing the valuation in the fintech startups world to almost $3 billion. The next step for Circle is to address one of the most significant issues in the crypto world: instability.

PitchBook

When looking at the top fintech startups, stop to check out PitchBook as well. This software provides information about public or private equity markets. The platform helps companies and investors or professionals to capitalize on new business opportunities using due diligence research for private market information or source investments.

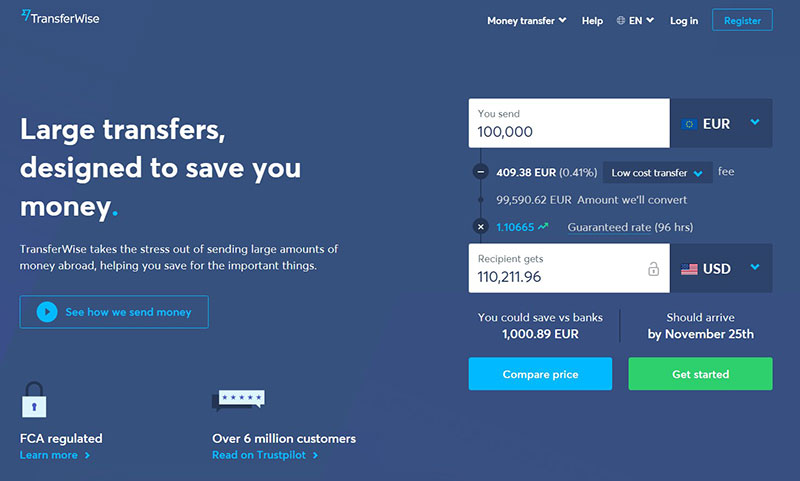

Transferwise

When you want to send money abroad, the process should be simple. However, banking services can sometimes move quite slow. Transferwise changed this, and now international transfers can be done fast, cheap, and accessible. There are no hidden fees. You always know the amount of money that the recipient is going to receive.

Inamo

In an ideal world, it would be fun to be able to take a bike ride or go surfing without the burden of having to carry a wallet or mobile phone with us. Using Inamo is going to help you with this. What Inamo did was to develop multiple products that are waterproof and attachable to watches and fitness bands, and this means you can enjoy the freedom of doing what you want with tap-and-go payments wherever Visa is accepted.

Brex

Fintech startups that reach unicorn status are quite impressive. Brex is one of them, achieving this feat in 2018, only a few months after it launched its first product. Now, it has received debt financing worth $100 million. Brex wants to target larger enterprises with its topic, and that is to open up the entire new set of customers.

Coinbase

For those that are fans of the crypto world, Coinbase is a popular platform where you can trade cryptocurrencies like bitcoin, ethereum, or litecoin. This crypto exchange idea was done back in 2012 by Brian Armstrong and Fred Ehrsma. It is reportedly being valued at $8 billion.

Coinbase also bought Earn.com for around $120 million and allows bitcoin users to pay using bitcoin.

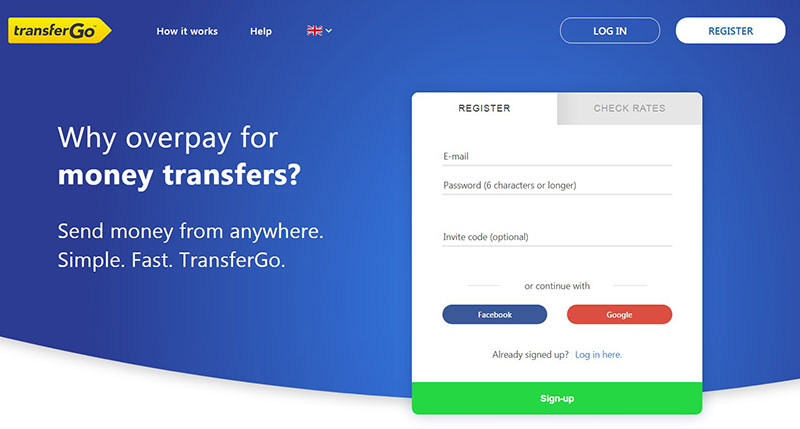

Transfer Go

Transfer Go is a global money transfer company which allows the users to send money from different countries without having any transaction fees. It raised $41 million in Series C funding to expand into more markets. The service has licensed under the Financial Conduct Authority FCA, and money can be transferred overseas using a digital account-to-account model.

AID:Tech

Many fintech startups end up finding success, and AID: Tech is one of them. What AID: Tech does is use Blockchain technology to bring transparency to the distribution of donations to the world’s underserved populations.

Ellevest

Ellevestis a technology company that was created to help women achieve financial potential. Ellevest helps women take control of financial futures using investing. This platform changed the traditional approach to investing in having a real-life, goal-based plan.

Trulioo

The service that Trulioo developed is exciting, and include instant bank-grade verification services that are used with compliance systems across the globe to help payment providers and financial services comply with the AML (Anti-Money Laundering).

Braintree

This is part of the PayPal payment services and is great for businesses of all sizes. It accepts payment types that range from credit cards to Venmo, and helps online companies to operate online and marketplaces to bolster security.

N26

This transparent and simple mobile banking mobile app is quite ingenious. There are no hidden fees, and mobile banking just got smarted because of it.

Combine

Combine was created in 2016 by Irakli Agladze and Denis Moskalets. They wanted to develop a mobile assistant that helps users control all their finances. Combine enables a secure connection for all accounts and then provides statistics, expenses, and income reports.

Commonbond

As student loan debts continue to be a common issue, Commonbond was created to bring a solution. It is a marketplace for lenders that helps lower the costs of student loans and give financial returns to investors. By using this solution, an average borrower saved up to $14,000 from the loan.

TrueLayer

If we think about all the fintech startups that brought a significant change in recent years, TrueLayer is one of them. TrueLayer has been around for two years, and aims to help small startups access banking data.

Digit

Digit is an excellent way to save money without thinking about the actual process. Every day, Digit checks the spending habits that you have, and it helps you save money from your account to the Digit account.

If you enjoyed reading this article on fintech startups, you should check out this one about top fintech apps.